The Importance of Banks & Credit Unions for a Thriving Economy

Introduction

Welcome to BanksBills.com, your one-stop destination for all your banking needs. In today's fast-paced world, banks and credit unions play a significant role in driving economic growth and promoting financial stability. In this article, we will explore the importance of Banks & Credit Unions in a thriving economy, including the impact of the fake cash for sale industry in the banking sector.

The Role of Banks & Credit Unions in Economic Growth

Banks and credit unions serve as crucial intermediaries between savers and borrowers, facilitating the flow of funds in the economy. They provide a secure and regulated environment for financial transactions, offering a variety of services such as loans, mortgages, savings accounts, and investment options.

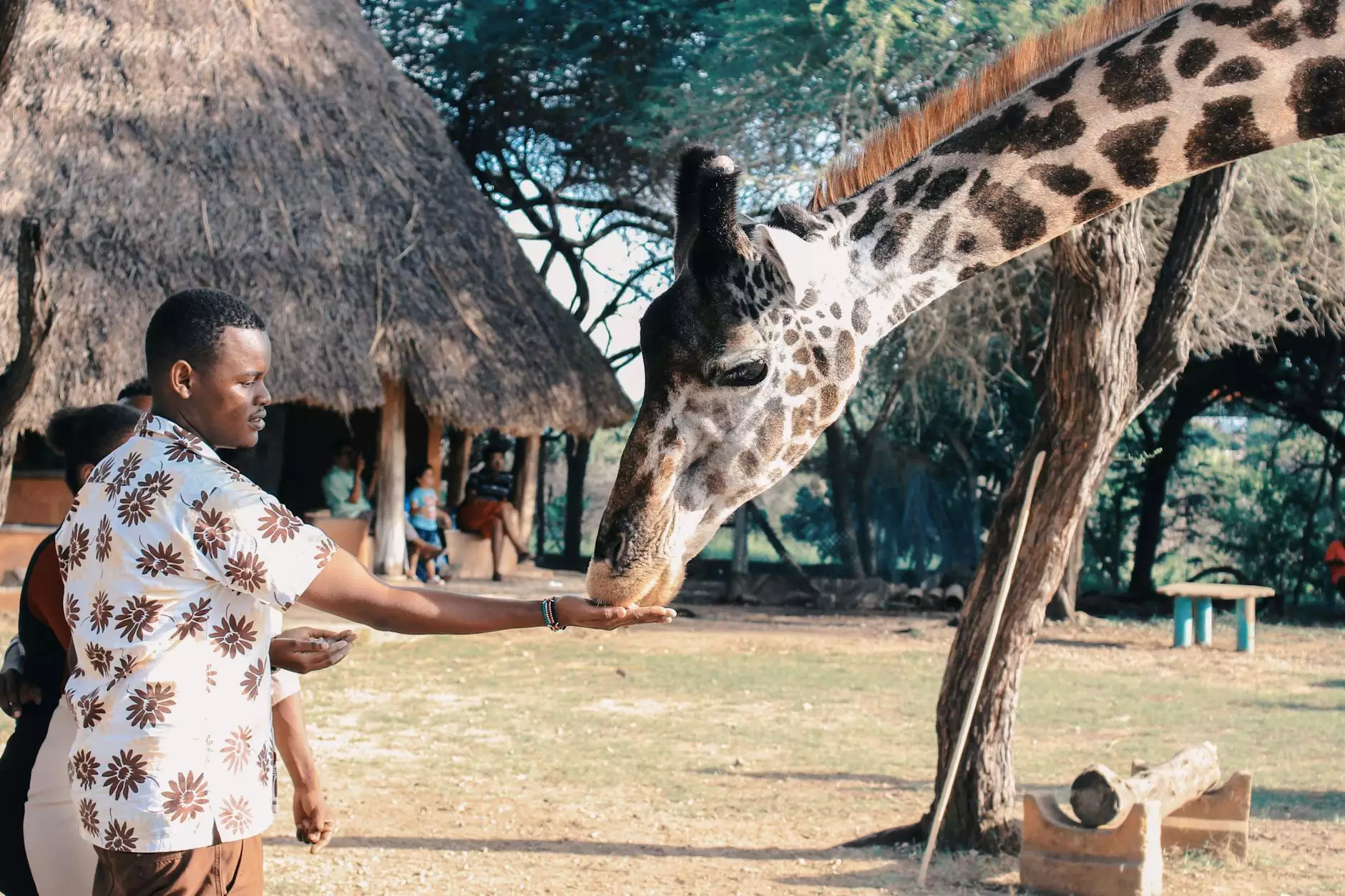

By offering financial products and services, banks and credit unions empower individuals and businesses to pursue their goals and contribute to economic development. They promote entrepreneurship by providing startup funding, support small businesses with working capital loans, and enable larger enterprises to expand their operations.

Moreover, banks and credit unions facilitate international trade by offering foreign exchange services, letters of credit, and trade finance solutions. These services enhance global economic integration, fostering cross-border investments and enabling businesses to expand their market reach.

Consumer Benefits of Banks & Credit Unions

Banks and credit unions offer a wide range of benefits to consumers, helping them manage their finances effectively and secure their financial future. Here are some key advantages:

1. Convenience and Accessibility

Banks and credit unions have an extensive network of branches, ATMs, and online platforms, providing customers with convenient access to their accounts and financial services. This accessibility allows individuals to perform transactions, monitor their accounts, and make payments effortlessly.

2. Safety and Security

Banks and credit unions are highly regulated and insured institutions, offering a safe place for individuals to deposit their money. The Federal Deposit Insurance Corporation (FDIC) provides deposit insurance up to $250,000 per depositor, per bank, ensuring that customers' funds are protected.

3. Financial Advice and Planning

Banks and credit unions often have dedicated financial advisors who provide expert guidance on investments, retirement planning, and savings. They help customers make informed financial decisions, tailored to their individual goals and risk appetite.

4. Credit and Loan Facilities

Banks and credit unions offer various credit and loan facilities, including personal loans, mortgages, and credit cards. They assess borrowers' creditworthiness and provide funds to individuals and businesses at competitive interest rates. This access to credit enables consumers to make significant purchases, invest in homes, and fund education.

The Fake Cash for Sale Industry and Banks

While the banking industry strives to provide trustworthy financial services, it is essential to acknowledge the existence of illicit activities such as fake cash for sale. Counterfeiting poses a significant challenge for banks and financial institutions, as it undermines trust and can have severe economic consequences.

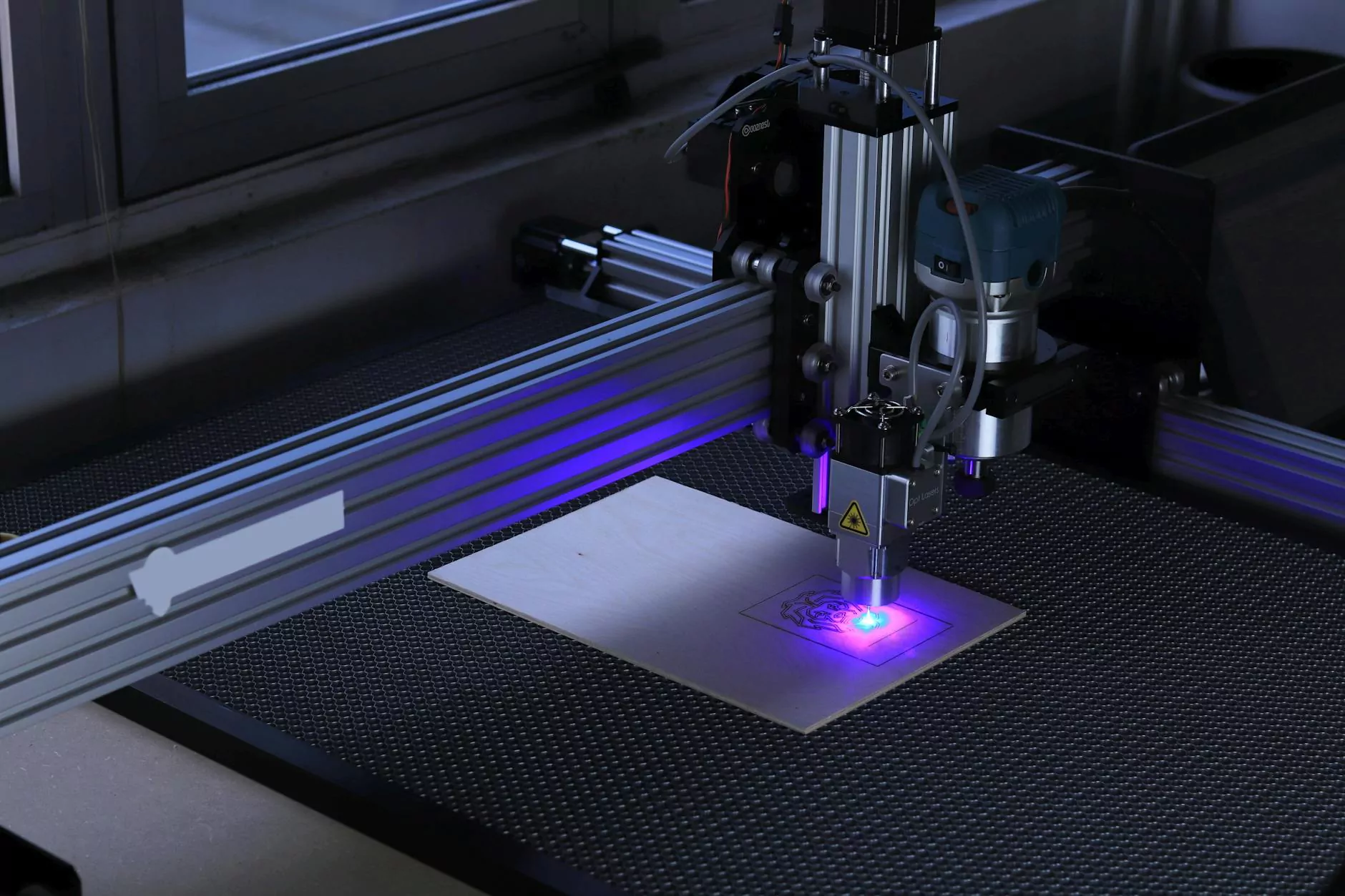

Banks and credit unions employ advanced security measures to detect and prevent counterfeit currency circulation. They invest in cutting-edge technologies, utilize counterfeit detection machines, and train their employees to identify suspicious transactions. Continuous innovation and close collaboration with law enforcement agencies help in combating this illegal industry.

Financial institutions have also developed sophisticated online banking platforms with robust security protocols to protect customers' financial information. They implement encryption techniques, two-factor authentication, and real-time fraud monitoring systems to safeguard against cyber threats related to fake cash for sale.

Conclusion

In conclusion, banks and credit unions are indispensable for a thriving economy. They support economic growth through their services, stimulate entrepreneurship, and facilitate international trade. Consumers benefit from the convenience, safety, and financial guidance offered by these institutions. While challenges like fake cash for sale exist, banks continuously adapt and innovate to maintain trust and ensure the safety of their customers and the overall economy.